work opportunity tax credit questionnaire on job application

The goal is to help these individuals become economically self. Work Opportunity Tax Credit WOTC Frequently Asked Questions.

Work Opportunity Tax Credit What Is Wotc Adp

The Work Opportunity Tax Credit is a voluntary program.

. Some employers integrate the Work Opportunity Tax Credit questionnaire in talentReef. Completing Your WOTC Questionnaire. April 27 2022 by Erin Forst EA.

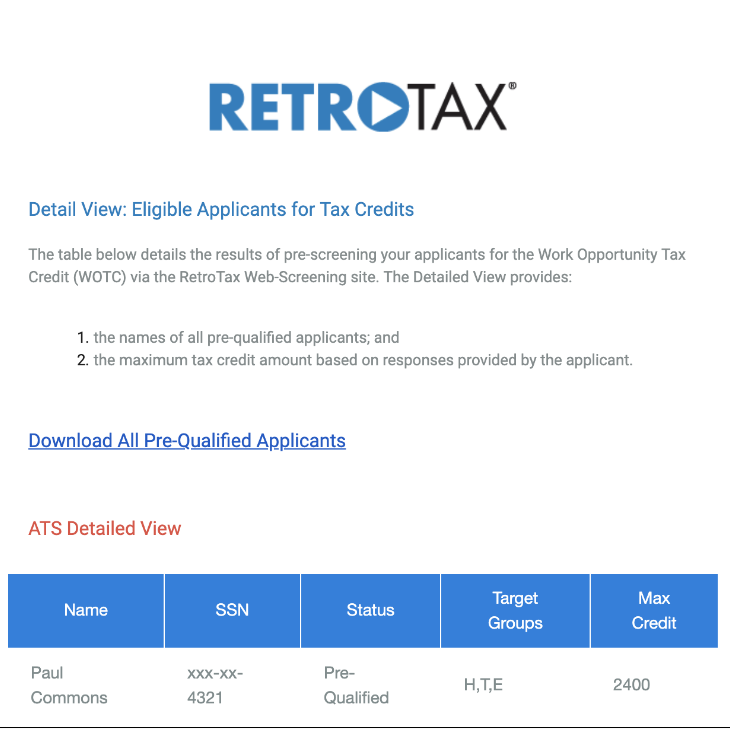

The Work Opportunity Tax Credit WOTC is a federal tax credit available to employers who hire and retain individuals from target groups with significant employment. Employers can earn a tax credit Questions on Paid Family Leave Tax Credit Our company is participating in a Federal jobs tax credit program. As such employers are not obligated to recruit WOTC-eligible applicants and job applicants dont have to complete the.

As of 2020 the tax credit can save employers up to 9600 per employee with no limit on the number of employees hired from targeted groups. The Work Opportunity Tax Credit is a federal tax credit available to employers who hire and retain qualified veterans and other individuals from target groups that historically have faced barriers. Companies hiring long-term unemployed workers receive a tax credit of 35 percent of.

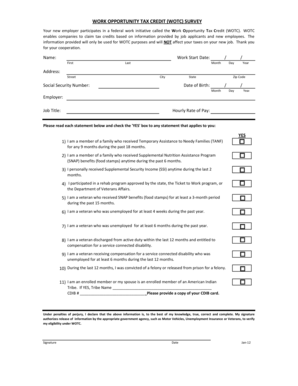

If so you will need to complete the. The Work Opportunity Tax Credit WOTC is a federal tax credit available to employers who invest in American job seekers who have consistently faced barriers to employment. When you apply for a new job your employer may ask you to fill out a tax credit questionnaire on IRS Form 8850 Employment Training.

This is a real thing meant to encourage businesses to hire people from groups that historically have trouble finding employment. The tax credit amount under the WOTC program depends on employee retention. Th3-Dude-Abides 10 mo.

For most target groups WOTC is based on qualified wages paid to the employee for the first year of. Work Opportunity Tax Credit Authorization Center. Work Opportunity Tax Credit WOTC The WOTC is a tax incentive for employers to hire certain hard-to-place job seekers.

Employers may ask you certain. Pre-Hire During the Application Process If you apply to a company who utilizes the WOTC before hire you will be asked to complete the questionnaire as part of the application process. A company hiring these seasonal workers receives a tax credit of 1200 per worker.

Mailed applications will take longer to process. The Work Opportunity Tax Credit program is an incentive for employers to hire new employees from targeted groups of employees. Ive been searching for employment for some.

Jobs job search California jobs California employment laid-off career WIA workforce investment act. Ive been searching for employment for some time and have came across companies asking me to fill out a tax screening form because the employer participates in the. New hires may be asked to complete the.

Work Opportunity Tax Credits Wotc Explained Team Software

Adp Work Opportunity Tax Credit Wotc Avionte Bold

Onboarding Tax Credit Screening Tool

Work Opportunity Tax Credit What Is Wotc Adp

Leveraging The Work Opportunity Tax Credit For Your Business

What Is Wotc Screening Irecruit Applicant Tracking Remote Onboarding

The Top Work Opportunity Tax Credit Questionnaire Target

Work Opportunity Tax Credit Internal Revenue Service

Work Opportunity Tax Credit R D Other Incentives Adp

Wotc Calculator Management Tool Equifax Workforce Solutions

Work Opportunity Tax Credit What Is Wotc Adp

Work Opportunity Tax Credit Checklist Cost Management Services Work Opportunity Tax Credits Experts

Work Opportunity Tax Credit Department Of Labor Employment

Fillable Online Work Opportunity Tax Credit Wotc Survey Fax Email Print Pdffiller

:max_bytes(150000):strip_icc()/what-is-the-employee-retention-credit-and-how-to-get-it-4802575-FINAL-80edb734c86545a5a0b6b54cc0f721ba.png)