vermont sales tax on alcohol

W-4VT Employees Withholding Allowance Certificate. The sales tax rate is 6.

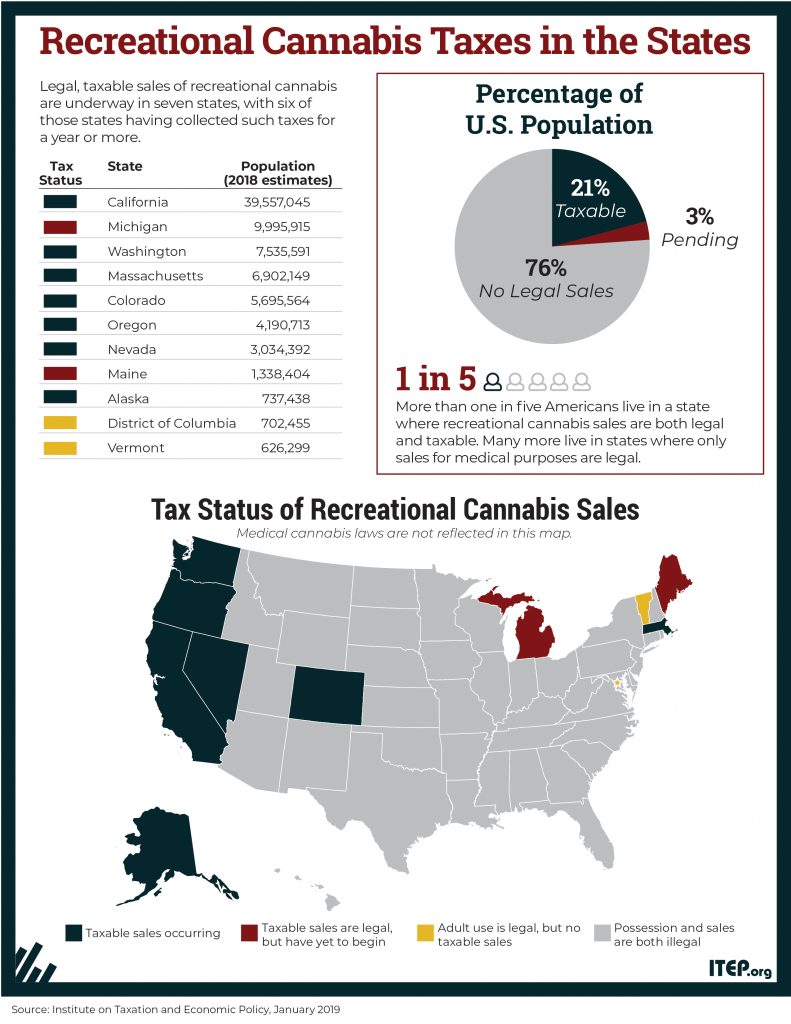

Alcohol Taxes On Beer Wine Spirits Federal State

For those who supply spirits to the Vermont Division of Liquor Control.

. Constitution repealed the Volstead Act Prohibition. 15th highest liquor tax. O Includes sales from State liquor agents to bars and restaurants.

IN-111 Vermont Income Tax Return. Vermonts excise tax on Spirits is ranked 15 out of the 50 states. Vermont Use Tax is imposed on the buyer at.

The Vermont sales tax rate is 6 as of 2022 with some cities and counties adding a local sales tax on top of the VT state sales tax. Sales up to 500000. Food food products and beverages are exempt from Vermont Sales and Use Tax under Vermont law 32 VSA.

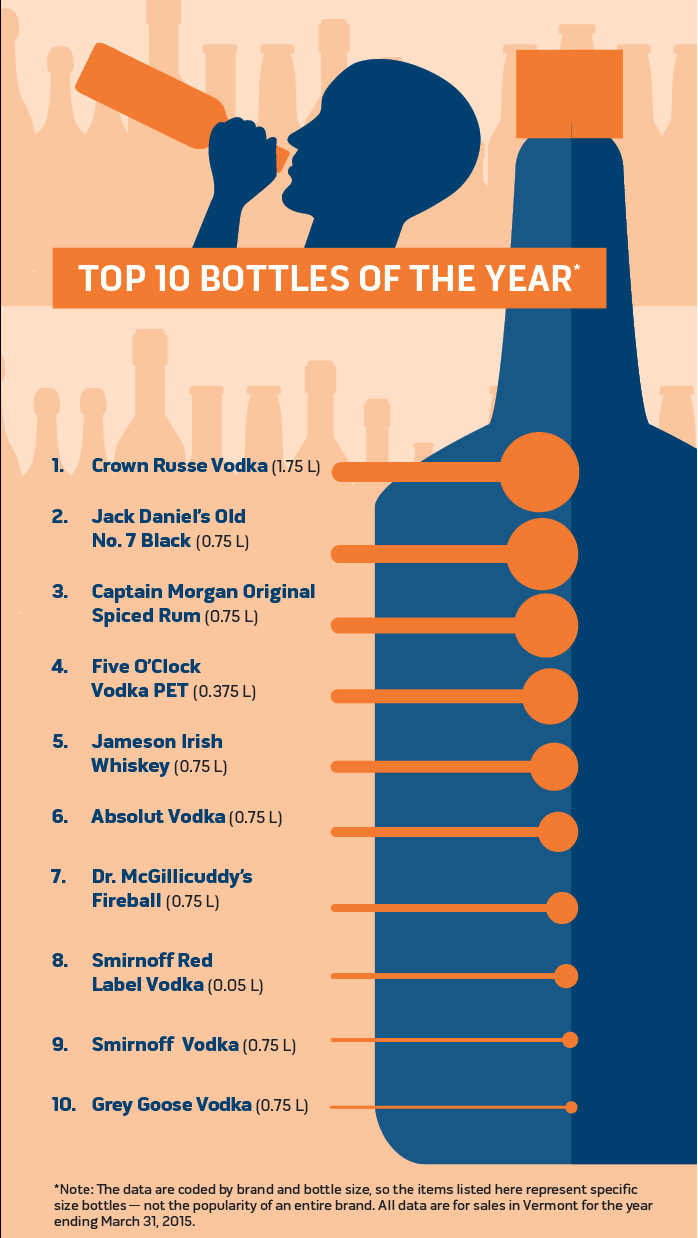

For beverages sold by. Control of the sale. Vermont is an Alcoholic beverage control state in which the sale of liquor and spirits are state-controlled.

Vermont Sales Tax is charged on the retail sales of tangible personal property unless exempted by law. The Vermont excise tax on liquor is 768 per gallon higher then 70 of the other 50 states. Summary of Vermont Alcoholic Beverage Taxes Beer and Wine Gallonage Tax 7 VSA.

Vermont state and local compliance rules for businesses shipping wine direct to consumers DTC in the state. Alcoholic Beverage Sales Tax. Vermonts general sales tax of 6 does not apply to the purchase of liquor.

Additionally wholesalers must pay a tax on spirits and fortified wines as follows. Alcohol tax Malt and Vinous Beverage Tax. Exemptions to the Vermont sales tax will vary by state.

For those who sell beer cider RTD spirits beverages or wine to stores or restaurants. Sales Tax on Shipping. Municipal governments in Vermont are also allowed to collect a local-option sales tax that ranges from 0 to 1 across the state with an average local tax of 0153 for a total of 6153 when.

Beer over 6 percent alcohol by volume. PA-1 Special Power of Attorney. The Vermont Division of Liquor Control DLC was created in 1933 when the 21st Amendment to the US.

974113 with the exception of soft drinks.

Vermont Income Tax Vt State Tax Calculator Community Tax

Sales Taxes In The United States Wikipedia

Vintage Advertising Print Alcohol Walker S Deluxe Snow Ski Bob Vermont Slope 61 Ebay

Bottle Racket Illinois High Alcohol Taxes Blow Up Cost Of Independence Day Celebrations

Vermont Sales Tax Calculator Reverse Sales Dremployee

Vermont Nh Alcohol Sales Continue With Pandemic Bump

Rising Liquor Sales Make The New Hampshire Vermont Border A Booze Battleground

Sales Taxes In The United States Wikipedia

Manufacturers Wholesale Dealers Vermont Department Of Liquor

Liquor Licenses Morristown Vermont

This Vermont Distillery Is Now Making Hand Sanitizer Outside Online

Vermont Income Tax Vt State Tax Calculator Community Tax

New Vermont Law Lowers Tax On Ready To Drink Cocktails Expands Sales Vermont Thecentersquare Com

Vermont Alcohol Taxes Liquor Wine And Beer Taxes For 2022

Rising Liquor Sales Make The New Hampshire Vermont Border A Booze Battleground

Vermont Mulls Pros And Cons Of Privatizing Liquor Sales Business Seven Days Vermont S Independent Voice